owner draw report quickbooks

It is another separate equity account used to pay the owner in quickbooks. The program computes the adjustments when you run a report for example QuickReport of Retained Earnings but you cant QuickZoom on these transactions unlike the manual adjustments you recorded.

There are three ways on how you can see the balances for both equity and sub-accounts in QuickBooks Online.

. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. How do I report an owners draw in QuickBooks. The funds are transferred from the business account to the owners personal bank account.

At the bottom left choose Account New. Select the Equity account option. Weve put together a few videos to help with QuickBooks reports.

Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts. Select the Gear icon at the top then Chart of Accounts. To create an owners draw account.

Open the chart of accounts use run report on that account from the drop down arrow far right of the account name. Am I entering Owners Draw correctly. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Select Save and Close. How do I show.

Select Owners Equity from the Detail Type drop-down. If youre curious about the notion of tracking the withdrawal of company assets to pay an owner in QuickBooks Online keep reading. Report Inappropriate Content.

Click Save Close. Select Equity from the Account Type drop-down. In this section click on the.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

QuickBooks Desktop doesnt have an actual transaction for closing entries it automatically creates. Click on the Banking menu option. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch.

Then choose the option Write Checks. To create an Equity account. For more details on how to record an owners draw in Quickbooks keep reading.

Select the Gear icon at the top and then select Chart of Accounts. How do i run that report. Set up and pay a draw for the owner.

To do so you are required to select the option of Chart of account at the QuickBooks online homepage and click on the feature option and now open the new tab and move to the drop-down bar of Account Type and choose the Equity option and. In the Write Checks box click on the section Pay to the order of. The second way to view the balance is to run the Balance Sheet Report scroll down to the Equity section and youll see the sub-accounts from there along with their balances.

Set up draw accounts. It is also helpful to maintain current and prior year draw accounts for tax purposes. Click Chart of Accounts and click Add.

Enter an opening balance. I just want a report on owners draw. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

At the bottom left choose Account New. Write Checks from the Owners Draw Account In QuickBooks Desktop software. Procedure to Set up Owners Draw in QuickBooks Online The Owners draw can be setup via charts of account option.

Setting up Owners Draw in QuickBooks Online. A members draw also known as an owners draw or a partners draw is a QuickBooks account that records the amount taken out of a company by one of its owners along with the amount of the owners investment and the balance of the owners equity. To record owners draws you need to go to your Owners Equity Account on your balance sheet.

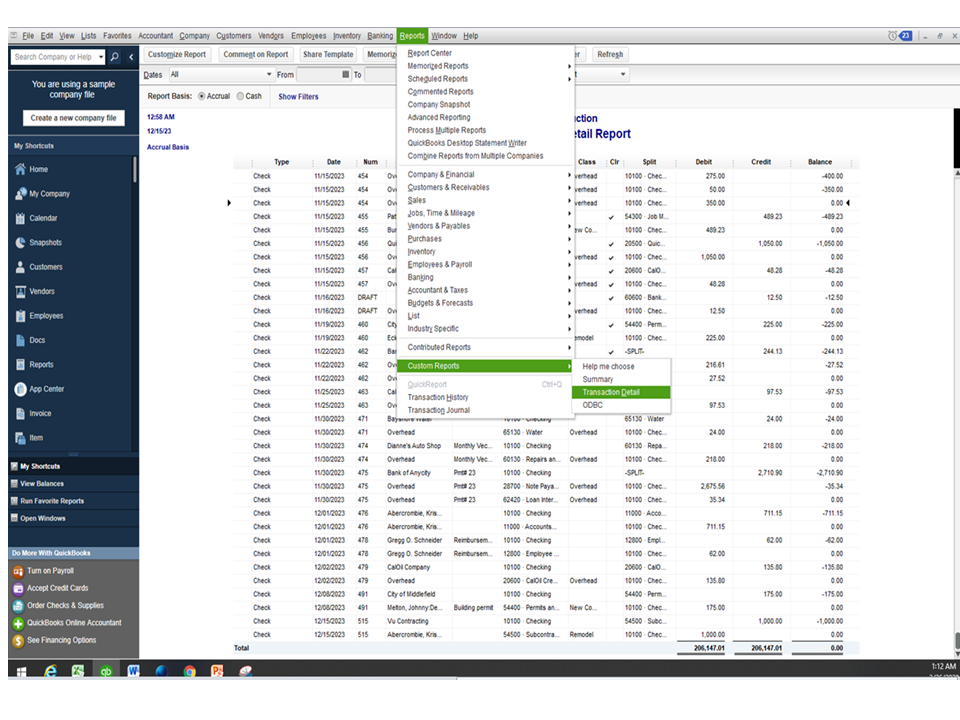

How do I show owners draw in Quickbooks. This article describes how to Setup and Pay Owners Draw in QuickBooks Online Desktop. The process for customizing your Profit Loss Reports differs in QuickBooks Desktop QuickBooks Online - In QuickBooks Desktop.

Select New in the Chart of Accounts window. Enter the account name Owners Draw is recommended and description. - Click on Reports Tab - Run the Profit Loss Report - At the top left of the Report click on the Customize Button - In the pop-up window set the Account Method to Cash Basis - Click Run Report - In QuickBooks.

If you own a business you should pay yourself through the owners draw account. Click Equity Continue. An owners draw account is an equity account used by quickbooks online to track withdrawals of the companys assets to pay an owner.

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. First you can view the accounts balances by viewing their register. Click Equity Continue.

How do you record ownership of a distribution. The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end of each accounting period - a calendar or fiscal year - which ever one your business uses. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

Click Save Close. How do I record an owners salary in QuickBooks. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck.

For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership. At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total. Any money an owner draws during the year must be recorded in an Owners Draw Account under your Owners Equity account.

Enter the account name Owners Draw is recommended and description. You would do this by Journal Entry. The funds are transferred from the business account to the owners personal bank account.

How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window. For initial personal start-up deposits made by the owner would they be recorded as an equity under either the Owner Investment or Owner Draws. An owners draw is a separate equity account thats used to pay the owner of a business.

Enter Owner Draws as the account name and click OK.

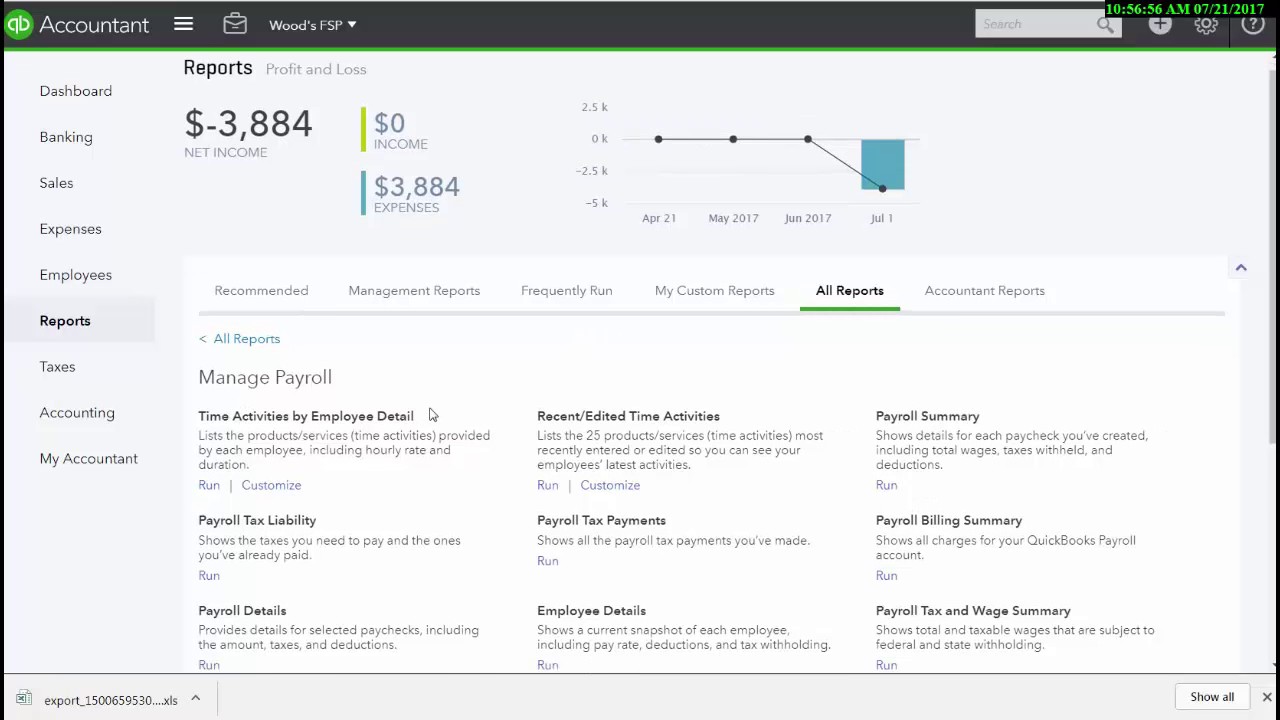

Quickbooks Online Full Service Payroll Report Navigation Youtube

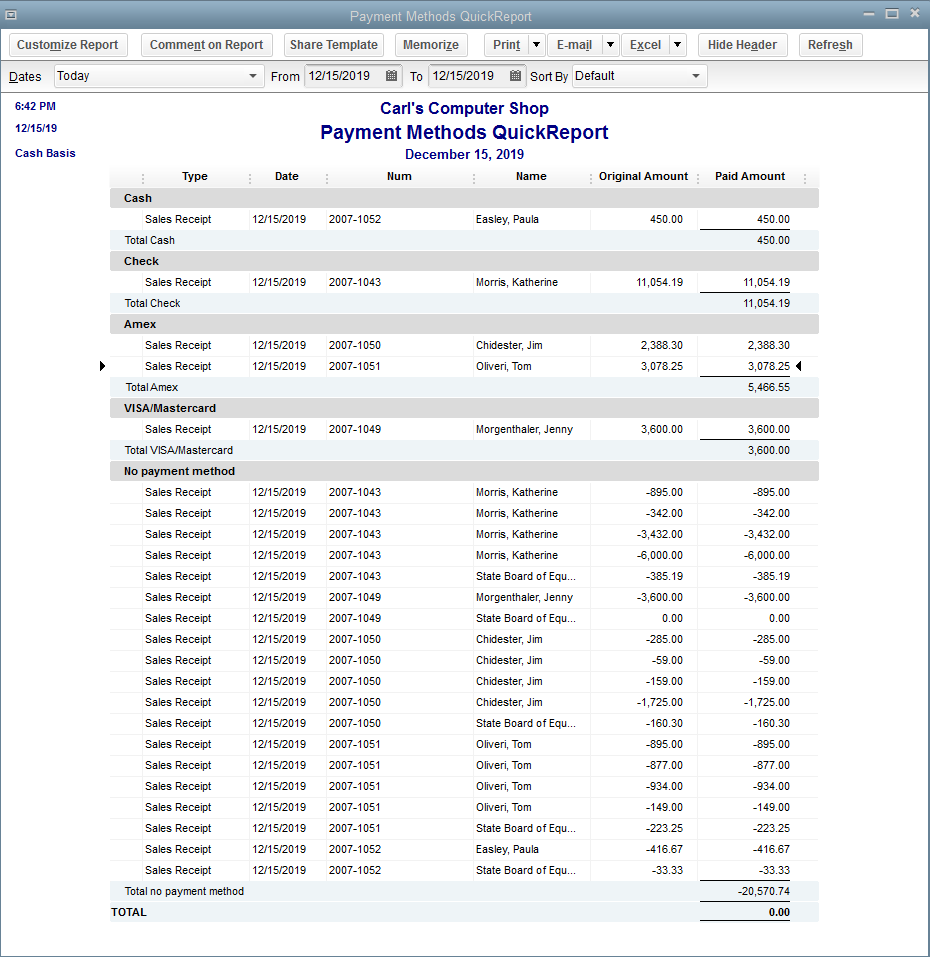

Daily Z Out Report For Quickbooks Desktop Sales Insightfulaccountant Com

Best 4 Quickbooks Chart Of Accounts Template You Calendars Https Www Youcalendars Com Quickbooks Chart Of Accou Quickbooks Chart Of Accounts Accounting

Quickbooks Job Costing Job Wip Summary Report Quickbooks Data Migrations Data Conversions

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

Creating Custom Conditional Formatting Rules In Excel Resume Words Adding Numbers Excel

Exclude Subclasses From P L Report By Class And S

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

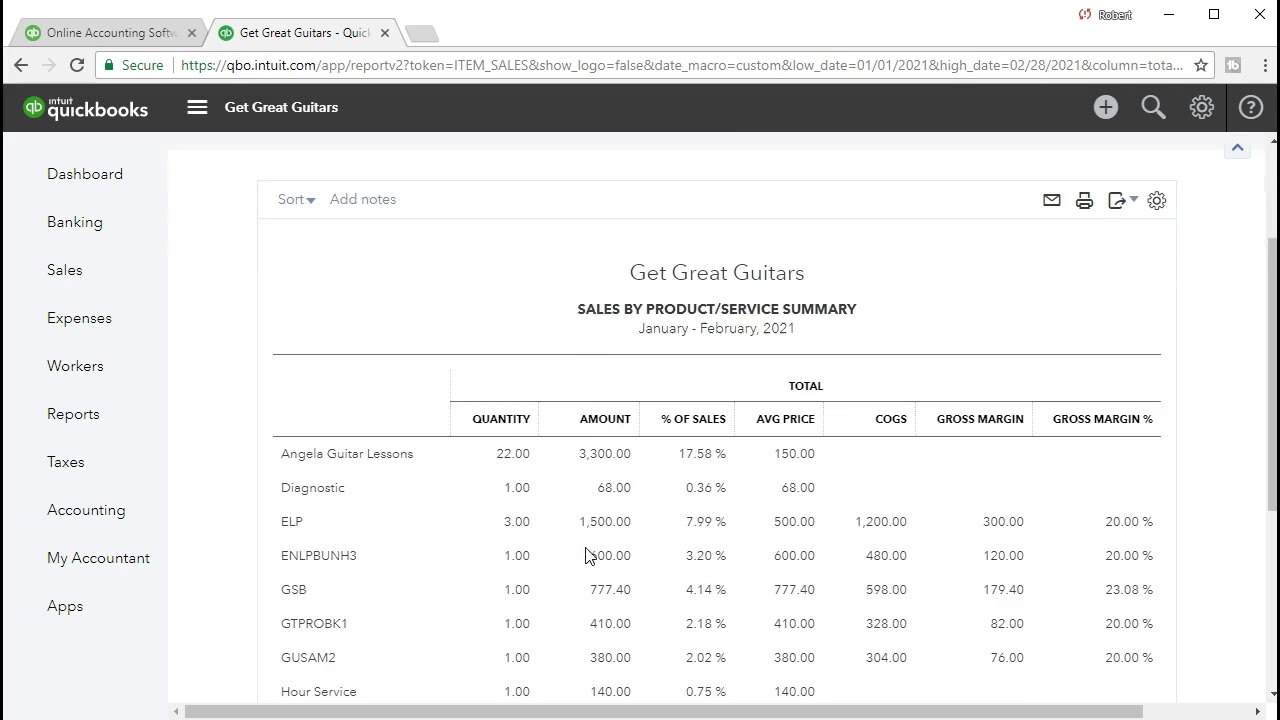

Quickbooks Online 4 25 Sales By Item Summary Report U Youtube

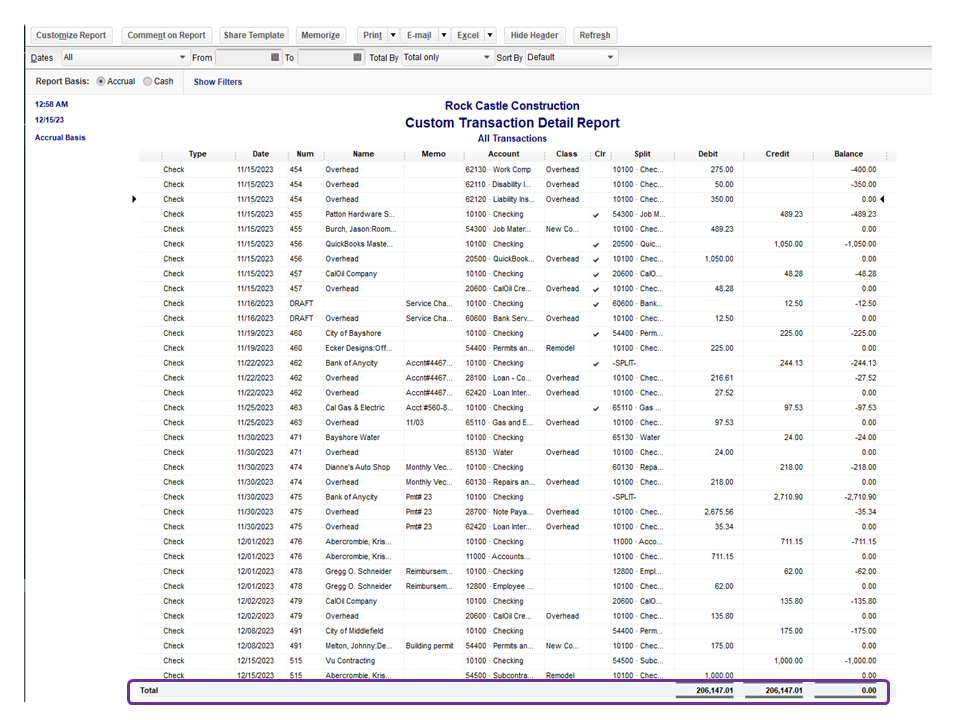

Custom Reports In Quickbooks Desktop Formatting Reports Working With Memos And Descriptions Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

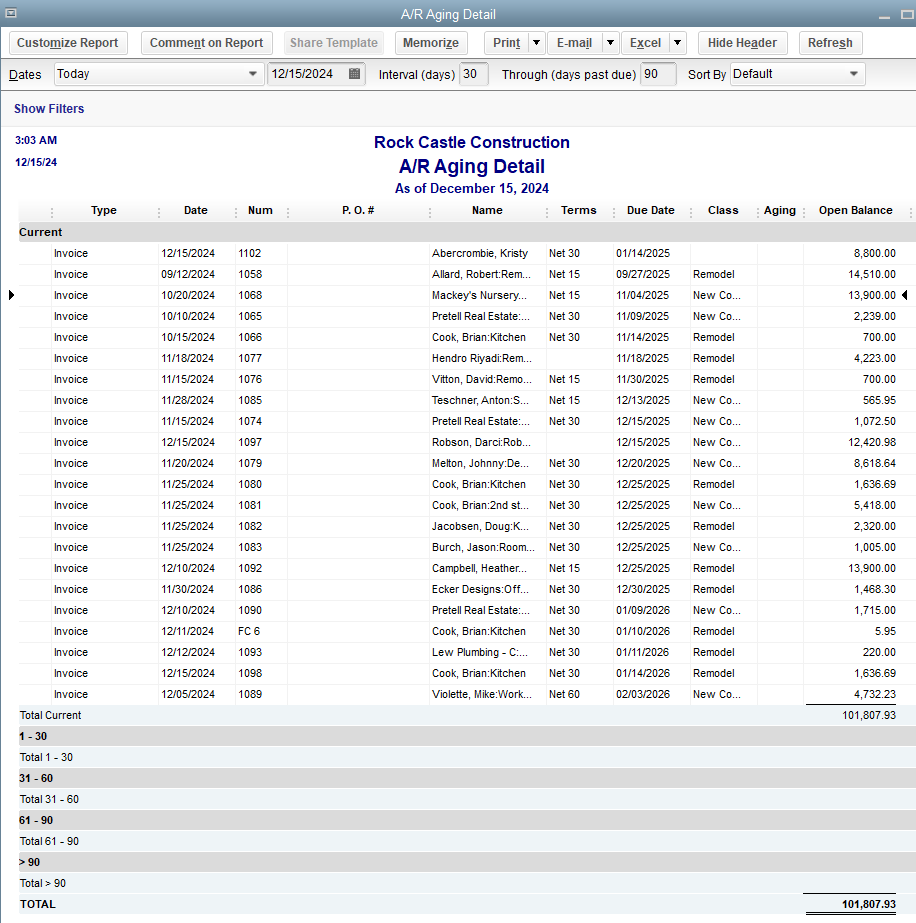

Accounts Receivable Aging Report

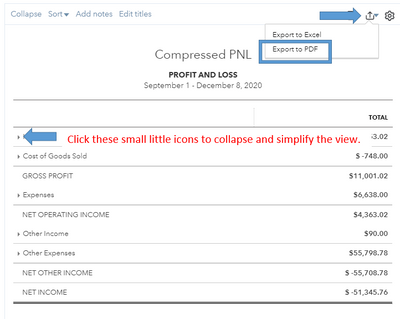

Solved Custom Profit And Loss Report

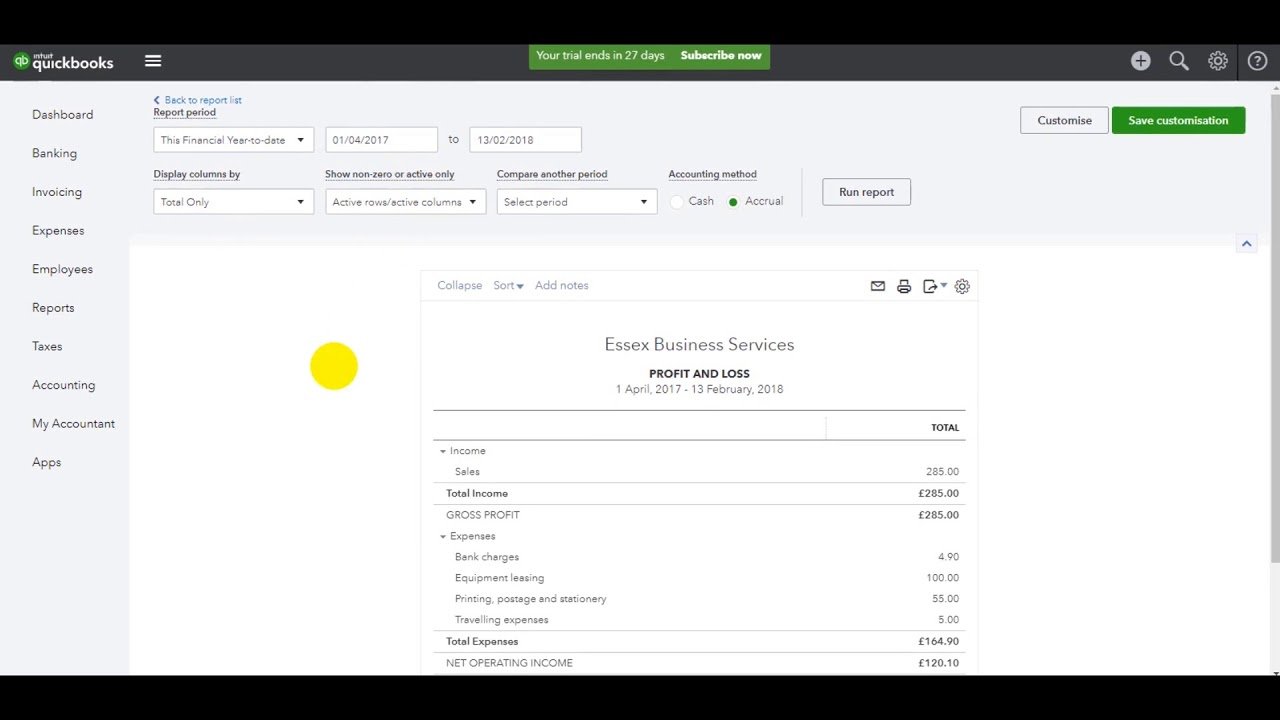

Quickbooks Online Tutorial Part 18 Viewing And Creating Reports Youtube

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register